HomeBlogFinancial InsightsWhat is a passthrough invoice?

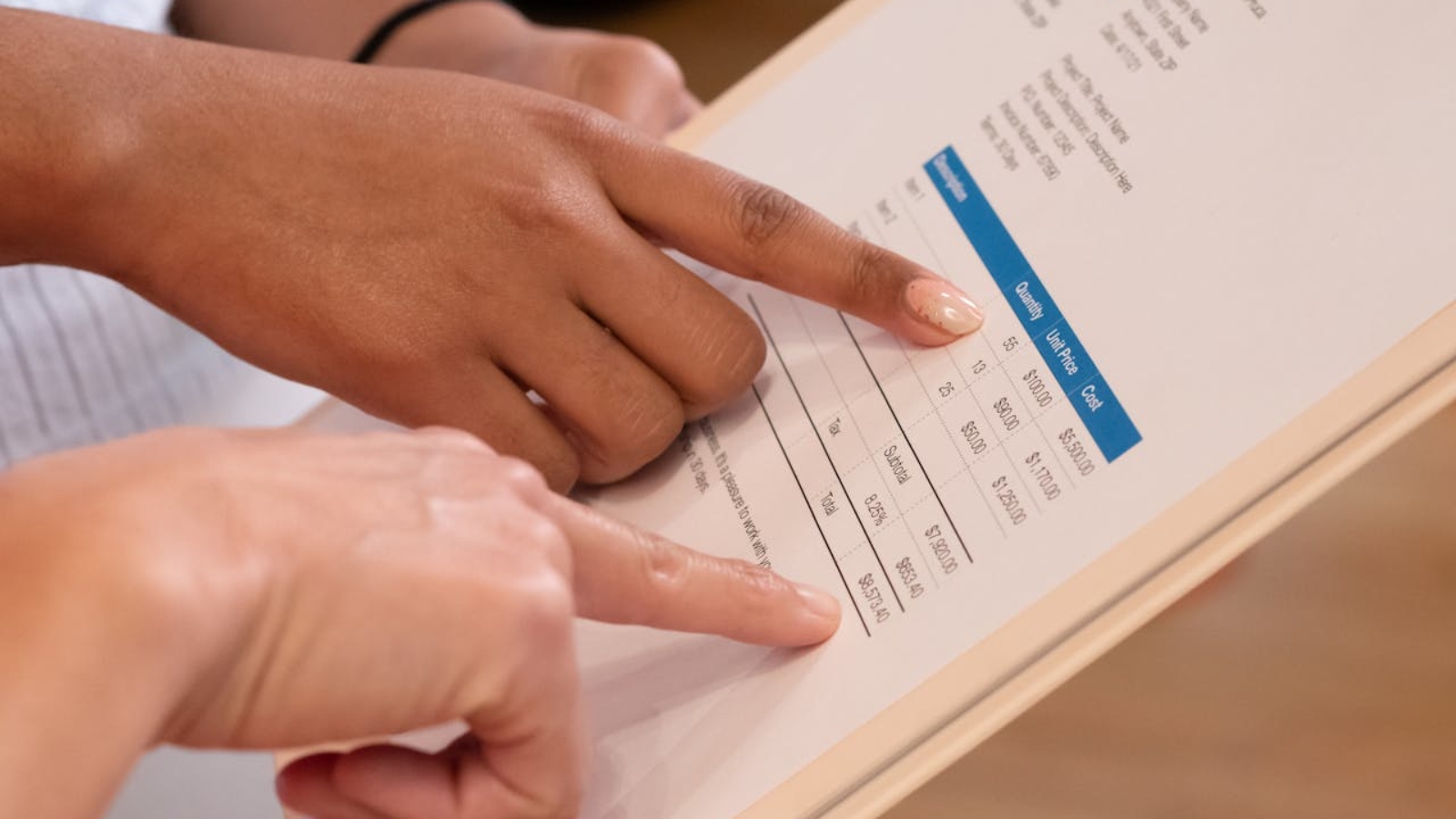

A pass-through invoice refers to a billing document issued by a business or service provider to recover expenses incurred on behalf of another party. Unlike traditional invoices that reflect revenue generated from selling products or services, pass-through invoices aim to recoup specific costs or expenditures directly from the client or end user.

Here’s a closer look at the characteristics and purpose of pass-through invoices:

Cost Recovery Mechanism

Pass-through invoices serve as a mechanism for businesses to recover expenses they’ve paid on behalf of a client or customer. These expenses could include items such as materials, subcontractor fees, or other out-of-pocket costs.

Transparency and Reimbursement

Pass-through invoices aim to provide transparency regarding the actual costs incurred by the business. By itemizing and documenting these expenses on the invoice, the business seeks reimbursement from the client or customer.

Separation from Revenue

Pass-through invoices are distinct from regular invoices for goods or services rendered. While traditional invoices represent revenue generated by the business’s core activities, pass-through invoices solely focus on recovering specific costs without generating additional income.

Contractual Agreements

The issuance of pass-through invoices often aligns with contractual agreements between the business and its clients or customers. These agreements typically outline the terms and conditions regarding cost reimbursement and invoicing procedures.

Financial Reporting Considerations

From a financial reporting standpoint, pass-through invoices may be categorized separately from revenue-generating invoices. Businesses may track pass-through expenses and associated reimbursements in dedicated accounts or expense categories for accurate financial analysis.

Facilitation of Business Operations

Pass-through invoices play a crucial role in facilitating certain types of business operations, particularly in industries where subcontracting, materials procurement, or other third-party expenses are common. They help ensure that the business is adequately compensated for the costs it incurs on behalf of its clients or customers.

In summary, pass-through invoices represent a key component of cost recovery strategies employed by businesses to recover specific expenses incurred on behalf of clients or customers. They provide transparency, facilitate reimbursement, and help maintain financial equilibrium in various business transactions.

Stay informed, stay compliant.